With the ongoing economic crisis causing banks to tighten their lending criteria, entrepreneurs may need to find alternative sources of funding to get their start-ups off the ground. In fact, 65% of entrepreneurs planned to seek alternative finance sources in 2012 and this will only grow in 2013, according to recent surveys.

With the ongoing economic crisis causing banks to tighten their lending criteria, entrepreneurs may need to find alternative sources of funding to get their start-ups off the ground. In fact, 65% of entrepreneurs planned to seek alternative finance sources in 2012 and this will only grow in 2013, according to recent surveys.

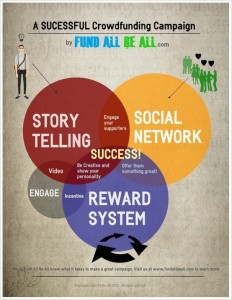

No one is claiming that crowd funding is an easy way to cheap investment opportunities, but these new platforms could offer your business a source of financing that is a good fit with the product or service your enterprise is developing. Use this checklist to ensure your crowd funding pitch reaches its investment goals:

- Perfect presentations – How your business presents the goods or services you want to develop is vital to get right. Your business must produce a compelling presentation to convince investors of your business’ value to them.

- Ask for the right amount – It’s important to do your homework when developing a crowd funding pitch. One of the fundamental mistakes often made is not asking for enough money to get your project off the ground.

- Promotion is vital – Your business can’t just rely on it’s the pitch that is on whichever crowd funding site your company is using. Your business still needs to have a complete and comprehensive promotional campaign to generate interest in your crowd funding pitch.

- Multiple investments – Crowd funding is just one way to potentially finance your business’ project. Often, a number of investment systems will need to be used to gain the level of investment your business needs. Don’t rely soley on crowd sourcing to fund your project.

Ultimately, crowd funding should be approached with all the due care and attention your business would use when looking for an investment from traditional sources.

The In-Crowd

- The biggest crowdfunding website is US site Kickstarter, founded in 2008

- More than 28,000 Kickstarter projects have successfully raised a total of $271m

- Eight Kickstarter projects have raised at least $1m each

- 44% of Kickstarter projects reach their funding goals – but 12% never get a single donation

- UK company Crowdcube launched in February 2011 allows start-ups to sell shares – currently not possible in the USA.

- 24 businesses have raised more than £3.9m via Crowdcube

- 10% of Crowdcube business pitches reach their funding goals; but those which do not reach their set target are not allowed to keep any money pledged

- The biggest investment by a single person on Crowdcube is £100,000 – the smallest is £10

Check out this page on crowd funding for up to the minute news, information and advice…